Have you ever questioned how to easily navigate the intricacies of Ocean County Tax Assessment Records?

What if we told you that understanding these records could potentially save you money on your property taxes?

Unraveling the intricacies of tax assessment processes may seem daunting, but with our step-by-step guide, you'll be equipped to navigate this terrain with confidence.

Stay tuned to uncover valuable insights on interpreting assessment data, utilizing online resources, and mastering the art of appealing tax assessment decisions.

Your path to property tax enlightenment starts here.

Key Takeaways

- Understand valuation process and property values for informed decisions.

- Access online resources for efficient data retrieval and assessment insights.

- Follow appeal deadlines and procedures for fair assessment review.

- Utilize sales listings and assessment data for financial planning and market comparisons.

Understanding Ocean County Tax Assessment

Understanding Ocean County Tax Assessment involves a detailed examination of the valuation process for real and personal properties in order to determine their taxation value accurately. In Ocean County, property owners can access Tax Assessment Records online, providing transparency into the Assessment Process. By reviewing these records, owners can gain insights into how assessors arrive at the value of their properties. Additionally, property owners can find crucial information such as Sales Listings and Tax Deduction Forms, aiding them in understanding their tax obligations better.

Moreover, with the 2023 Tax Rate set at $2.323 per $100 of assessed value, comprehending how properties are valued becomes paramount. This understanding allows property owners to assess if their properties have been fairly evaluated for tax purposes. Furthermore, being aware of the Assessment Appeals process is vital. Should property owners disagree with their property's assessed value, they've the right to appeal, ensuring a fair assessment of their tax burden.

Locating Tax Assessment Records

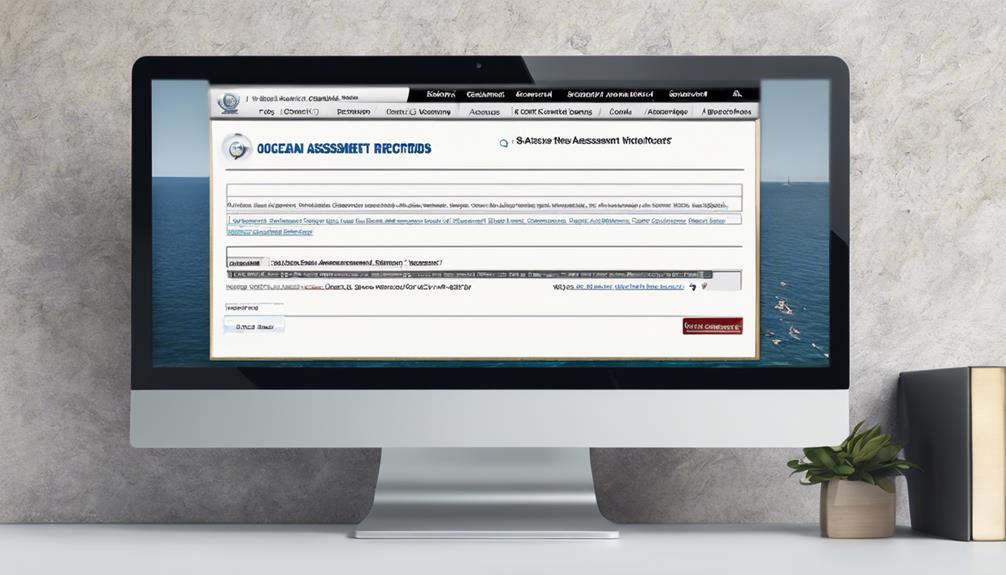

To access Ocean County tax assessment records, visitors can navigate to the Ocean County Board of Taxation website. Once on the site, individuals can find a wealth of information, including property assessment details, sales listings, and tax appeal instructions. For those seeking additional assistance, the Ocean County Board of Taxation's physical address is 101 Hooper Avenue, Toms River, NJ 08753.

If you want to quickly locate specific records, utilize the search function available on the website. Moreover, for a comprehensive understanding of the tax appeal process, it's advisable to review the addendum to Tax Appeal Instructions provided in PDF format. This resource can be particularly helpful for property owners looking to navigate the system effectively.

Interpreting Tax Assessment Data

Navigating through the wealth of tax assessment data available on the Ocean County Board of Taxation website provides property owners with crucial insights into property values, sales information, and assessment ratios for informed decision-making. By delving into tax assessment data, property owners can better understand their tax obligations and potentially uncover grounds for appeal.

Examining assessment trends over time can reveal fluctuations in property values and tax rates, aiding in long-term financial planning. Detailed property assessment records offer transparency into the valuation process, empowering property owners to make informed decisions.

Additionally, comparing assessment data with neighboring properties can assist in determining fair market values, ensuring a more accurate assessment of property worth. Understanding the nuances of tax assessment data is essential for property owners looking to navigate the intricacies of property valuation and taxation effectively.

Utilizing Online Resources

Utilize the Ocean County Board of Taxation website to access comprehensive property assessment information and sales listings efficiently. When navigating the site, take advantage of the search function to quickly locate specific details. The website offers the Addendum to Tax Appeal Instructions in PDF format, providing valuable reference material for users. For any inquiries or additional assistance, reach out to the Ocean County Board of Taxation at 101 Hooper Avenue, Toms River, NJ 08753.

- Efficient Search Function: Easily find the information you need by utilizing the website's search tool.

- Downloadable Resources: Access the Addendum to Tax Appeal Instructions in convenient PDF format for your reference.

- Detailed Property Assessment Information: Explore the site for comprehensive and detailed assessment details on properties.

- Sales Listings Availability: View sales listings online to stay informed about property transactions in the area.

Appealing Tax Assessment Decisions

When considering appealing tax assessment decisions in Ocean County, property owners must ensure timely submission of required forms to the County Tax Administrator or City's Tax Assessors Office. In Ocean County, appeal deadlines are critical, typically falling on April 1 annually for property value appeals and December 1 for added/omitted assessments.

The County Board of Taxation oversees the assessment appeals, guaranteeing a fair process for taxpayers. It's crucial for property owners to understand the appeal process and deadlines, as timely submission of appeal forms is essential for consideration and review by the County Board of Taxation.

Frequently Asked Questions

Are Property Tax Records Public in Nj?

Yes, property tax records are public in NJ. They offer insight into assessments, payments, exemptions, and ownership details. Accessible through various channels like the Tax Assessor's Office or online, these records help owners grasp tax responsibilities, monitor assessment modifications, and verify bill accuracy.

Transparency in assessment and tax administration is enhanced through public access to these records, fostering accountability.

How Does NJ Assess Property Value?

When assessing property value in New Jersey, factors like market conditions, location, size, and property amenities play a crucial role. Local tax assessors evaluate these aspects to determine the property's assessed value, which is then used to calculate property taxes.

Considerations such as recent sales of similar properties and any improvements made to the property are taken into account. Property owners can appeal assessments they believe are inaccurate or unfair.

Can a Tax Assessor Come on Your Property in Nj?

Yes, tax assessors in New Jersey can come on our property to conduct assessments. They visit to inspect and collect data to ensure accurate property valuation for taxation. Property owners are typically informed in advance of assessments.

Assessors may take measurements and notes during their inspection to determine property value. This process is standard to ensure fair and precise property assessments for taxation purposes.

How Do I Challenge My Property Tax Assessment in Nj?

Challenging property tax assessments in NJ involves filing an appeal with the County Board of Taxation by April 1 annually. Obtain appeal forms from the County Tax Administrator or City's Tax Assessor's Office. Timely submission is crucial for consideration.

Understanding deadlines and the process is key. By following these steps, property owners can effectively challenge their property tax assessments in New Jersey.

Are there any specific steps or tips for accessing Ocean County tax assessment records?

Accessing complete Ocean County tax assessment records can be a straightforward process by visiting the official Ocean County tax assessor’s office in person or through their website. Additionally, you can also request the records via mail or email by contacting the assessor’s office directly.

Conclusion

As we navigate the intricate waters of tax assessment in Ocean County, let's remember that understanding our property values is like charting a course through a vast ocean.

By utilizing the tools and resources provided in the guide, we can steer our way towards a clearer understanding of our tax obligations and rights.

Just as a skilled sailor navigates the waves, we too can navigate the complexities of tax assessment with knowledge and confidence.

Eugene brings a fresh, dynamic voice to our platform as one of our talented Writers. Specializing in research-driven content, he explores the latest findings in psychology and personal growth, translating them into actionable insights for our readers. Eugene’s work is fueled by a curiosity about what makes us tick and a desire to help others unlock their potential.